See about how i track results here

The first quarter of 2021 was pretty static .I made a positive return but that

was very marginal. Most of my returns came from Macys appreciation and

facebook steadily going up, but that was offset by the substantial

losses i got from increasing my position in Pireus Bank which 2 months

after increasing my position announced share capital increase . That's

another lesson of how careful someone should be when buying banks, price

to book ratio which is one of the most loved ratios when buying banks

can leave you with a false feeling of confidence

that you have a big margin of safety. Asset quality is very important and in the environment that banks work where capital requirements can change any time,they may force banks quickly change their leverage profile ,even if banks have returned to profitability, they may be forced to do big clean ups in their balance sheet at the expense of shareholders.

Paperpack Manufacturer (PPAK) : + 65.7 %

Public Power Corporation (DEH): + 65.19

National bank of Greece(ETE): + 99.89%

Pireus Bank: +64.61 %

Profit from closed positions: 4,8 working salaries.

Portfolio:

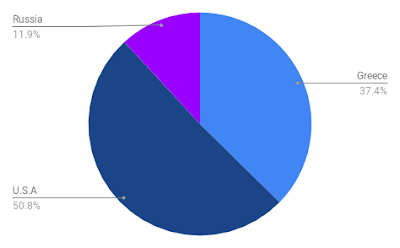

My Portfolio now consists of 6 stocks.

2 Greek stocks: Tpeir (Pireus Bank) and Alphabank.

2 energy stocks: Gulfport Energy (a natural gas upstream company) and Gazprom the biggest natural gas producer in the world

Lastly i have Facebook and Macy's.

In the following graphs i list the stocks By weight, Country and Sector-industry

Year on Year monthly passive income: - 69% of monthly working Salary

2021 1st Quarter Results (monthly adjusted): 5% of monthly working salary every month

Performance Comparison