It's so cool to see dividends coming right? owning companies that pay you dividend it's so satisfying. Yet we have to look at facts and objectively speaking dividend investing is so inefficient way of investing and that includes all forms of dividend investing including dividend growth investing, reinvesting dividends or living off dividends.

First of all we have to remember that dividends usually come from business earnings ,a company that pays dividends has less money to re-invest and grow. I say usually because a company can also borrow money to pay a dividend , but that is working for only a short period of time . All people before retirement should only care for the growth of the value of the portfolio and not for the dividends they get from it. That's because they are net contributors to their portfolio, they dont use the dividends to cover their expenses ,meaning any form of return they get is re-invested to grow their portfolio till they reach their goal . By buying dividends stocks they just choose to take some money from the business and reinvest them themselves instead of trusting the business. To be clear it's not bad for a company to pay a dividend, it's realistic. Money that cant be used to bring the required growth for the perceived risk an investor gets by holding the stock are better to be returned.Also more often than not businesses retain money to grow while it would be better to give back the money, if that's the case we are talking about, this can be reflected to a lower price, every stock price comes from expected returns. If you pay the right price even if a company doesnt do the best thing, you can get you fair market returns or even better than fair market returns if the stock is mispriced and positive surprises happen in the future. On the contrary a company that does everything at it's optimum can give you worse returns than "fair" because maybe you bought at a very high price when all the positives were priced , no negative changes were considered and not much room for positive surprises were left . The whole point is that it all comes to valuation. And the stock market works that way, stocks that pay dividends can be bad or good investments for you , even if they are good companies that afford to pay dividends. They can give you bad returns if you overpay for them , it doesnt matter if they pay a dividend or not. If you are not using the money from dividends to cover your expenses but to re-invest them, then focusing on the dividends is an illusion .

Dividend investing methods

DRIP

That's when you choose instead of receiving the dividend to get it automatically re-invested in the same stock. What is called DRIP, if the broker doesnt offer this choice, the investor can do this manually. That's like the company doing a buyback , that would only make sense if the stock was undervalued, the company decided to give you that money but you chose to buyback more of the stock. There is no rational reason behind doing this if you are dividend investor and you want the dividend. If you think that the company allocates the money it earns efficiently, then let it do the buybacks , and buy more of the stock if you have a reason to believe it''s undervalued. There are many companies that choose to do buybacks instead of paying a dividend but dividend investors ignore them

Dividend growth investing

Nothing original here too, dividend investors fooling themselves that they are getting better returns from simple dividend investors by investing in companies that grow their dividends yearly by more than 10%. Usually these companies have low dividend yield, lower than 2%. Well again for this to become a 4%-5% dividend yield on cost stock ,it would take so many years that there is no real advantage of buying these over a no growing reliable high dividend yield stock .If you only care for dividends and no capital appreciation, to see any excess return from the low yield ,high dividend growth stock you may have to wait more than a decade . What you actually do is avoiding high dividend yield stocks that have more risk of being value traps than low yield stocks . So instead of higher dividend performance what you really get is more safety by avoiding stagnating or companies on decline.

Living off dividends

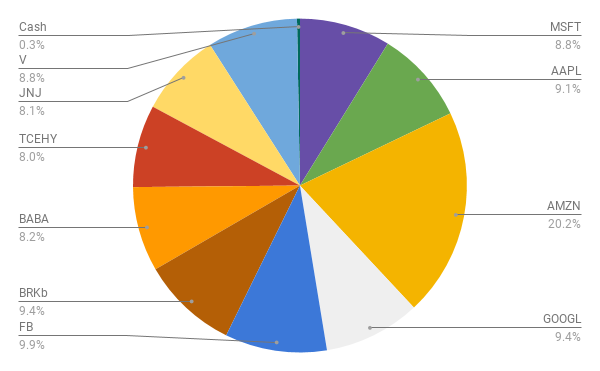

If you are at the stage you have enough capital to retire then putting all your money on dividend stocks, is a strategy that is not giving you better returns or safety. If you are at the stage you can really live from passive income ,you are better doing this by having a well diversified portfolio that not consists only of dividend stocks. When the market crash , you will see your portfolio crash even if you hold dividend stocks you will feel the pain, you can also see companies cut dividends because they are changing the plans to avoid future risks. The yield you usually aim from a dividend stock portfolio would be anyway less that 4%, that's your aim when you want to live off dividends. But there is a safer way to get a similar and better yield from your portfolio without relying on dividends and constantly having to check the updates of the companies you hold. You move into a fixed portfolio that allocates your money into Gold, Government bonds ,cash, commodities and stocks. That way you can create a portfolio that gives you the returns you want with less risk. You get your returns by adjusting it every year or quarter or whatever you choose , there are many portfolios like these. That way you take advantage of all the possible assets that the money can flow into ,you have no need to assess individual companies and you reduce the risk of markets violent swings . You wont to have to worry if a company decides to cut the dividend , don't bet on that when a company does this you will sell the stock, the moment that this happens you will see the price of the stock fall significantly and you will lose more than the small dividend

There is no real objective advantage of buying dividend stocks if you are active investor, only psychological advantages which ofcourse are of high importance ,that can make dividend investing strategy worth following. You can follow any strategy you want , you can do what you feel more comfortable doing and dividend investing it's a good way to start but not a place to hide an investors ignorance . I personally like dividend stocks if i considered them undervalued because you can wait and collect some money while you are waiting the stock to come to their fair value , i know how tempting is to look at dividends but i try to not stick to that especially when i chase big returns , i have to focus on where the excess returns come and those come by capital appreciation when the stock is priced less on what fundamentals, growth opportunities and risk indicate.