Last year i decided to track a simple strategy of investing in the 10 largest market cap stocks for a year and then re-balance it every year. The results were stunning.

The hypothetical portfolio was based on a initial capital of about 10,000 euros . Each stock would approximately weight about 10% of the portfolio. Since some stocks were very expensive they got more. Same with re-balancing. The re-balance wont be perfect. But more or less i will be close in following the strategy of owning the 10 largest cap stocks. This strategy is simple.

The stocks were bought in 9/9/2019. Total Amount Invested: 11,216.13$

So here are the stocks that made the list:

1. Microsoft (8 stocks, price:136) 1088$ (weigh: 9.7%)

2. Apple (16 stocks, price: 55.90) 894.4$ (weigh: 7.97%)

3. Amazon ( 1 stock, price: 1833.51) 1833.51$ (weigh: 16.35%)

4. Alphabet A-Google (1 stock, price: 1205.7) 1205.7$ ( weigh: 10.75%)

5. Facebook ( 7 stocks, price: 190.9) 1336.3$ (11.9%)

6. Berkshire Hathaway ( 4 stocks, price: 210.91) 843.64$ (weigh: 7.5%)

7. Alibaba (7 stocks, price: 170.78) 1195.46$ (weigh: 10.66% )

8. Tencent ( 20 stocks, price: 43.3) 866$ (weigh: 7.72% )

9. JPMorgan (8 stocks, price: 117.19) 937.52$ (weigh: 10.66% )

10. Johnson & Johnson ( 8 stocks, price: 126.95) 1015.6$ (weigh: 8.36%)

1 year later the portfolio appreciated 45%,beating S&P and most of all other portfolios you will find. I assumed 30% tax on dividends and no transaction costs .

Here is a more detailed view of the returns

1. Apple (↑ 103.95%) +dividends (↑ 108.19%)

2. Amazon ( ↑79.11%)

3. Alibaba (↑57.5%)

4. Microsoft (↑ 51.35%) +dividends (↑ 52.40%)

5. Tencent (↑50.07%) +dividends (↑ 50.31%)

6. Facebook (↑40.92%)

7. Alphabet A-Google (↑24.42%)

8. Johnson & Johnson ( ↑15.72%) +dividends (↑17.88 %)

9. Berkshire Hathaway (↑3.27%)

10. JPMorgan (↓-14.30%) +dividends (↓-12.15%)

Total: 16,289.805 (↑45.24%)

Now that was time to reallocate. Amazon was too big to do

any sale but i tried with the rest to do the best i could. First, 2

stocks needed to be removed from the list was JP Morgan and marginally Johnson

and Johnson. New additions would be Visa and Walmart. Since Johnson and

Johnson was very close to Walmart, i kept it and i only

replaced JP Morgan with Visa.

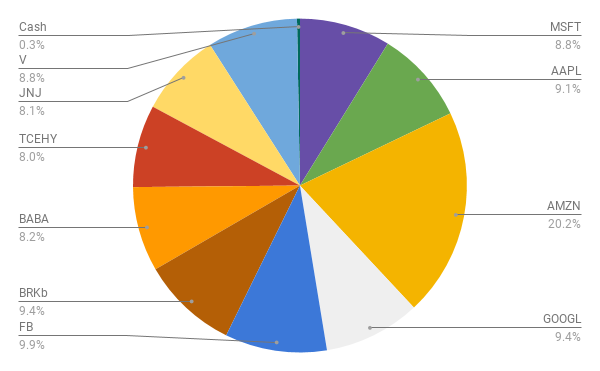

Here how the Portfolio is at 10/09/2020 after re- allocation. Total: 16244$ + cash: 45.805

1. Microsoft (7 stocks, price:205.37) 1437.59$ (weigh: 8.85%)

2. Apple (13 stocks, price:113.49) 1475.37$ (weigh:9.01%)

3. Amazon ( 1 stock, price: 3284) 3284$ (weigh: 20.22%)

4. Alphabet A-Google (1 stock, price: 1526.05) 1526.05$ ( weigh: 9.39%)

5. Facebook ( 6 stocks, price: 268.09) 1608.54$ (9.9%)

6. Berkshire Hathaway ( 7 stocks, price: 217.8) 1524.6$ (weigh: 9.38%)

7. Alibaba (5 stocks, price: 267.55) 1337.75$ (weigh: 8.23% )

8. Tencent ( 20 stocks, price: 64.98) 1299.6$ (weigh: 8% )

9. Johnson & Johnson ( 9 stocks, price: 146.91) 1322.19$ (weigh: 8.14%)

10. Visa ( 7 stocks, price: 204.17) 1429.19$ (weigh: 8.8%)

So as you see the Amazon stock is more weighed due to the high price of stock per share relative to the size of the portfolio. In the future they will probably make a stock split and would be easier to weigh it on near the 10% target.

45% returns in such a troubled period shows how the large market players can gain instead of losing during a crisis by wiping out smaller players .

By comparison S&P returns during that period with dividends were around 14.1%.

10 Largest market cap stocks returns: (↑45.24%)

S&P Returns: (↑14.08%)

Nadaq returns: (↑35%)

S&P Outperformance: 31.16%

Nasdaq Outperformance: 10.24%

Lets see how the next year will be! With this easy to apply strategy

No comments:

Post a Comment

share your comment